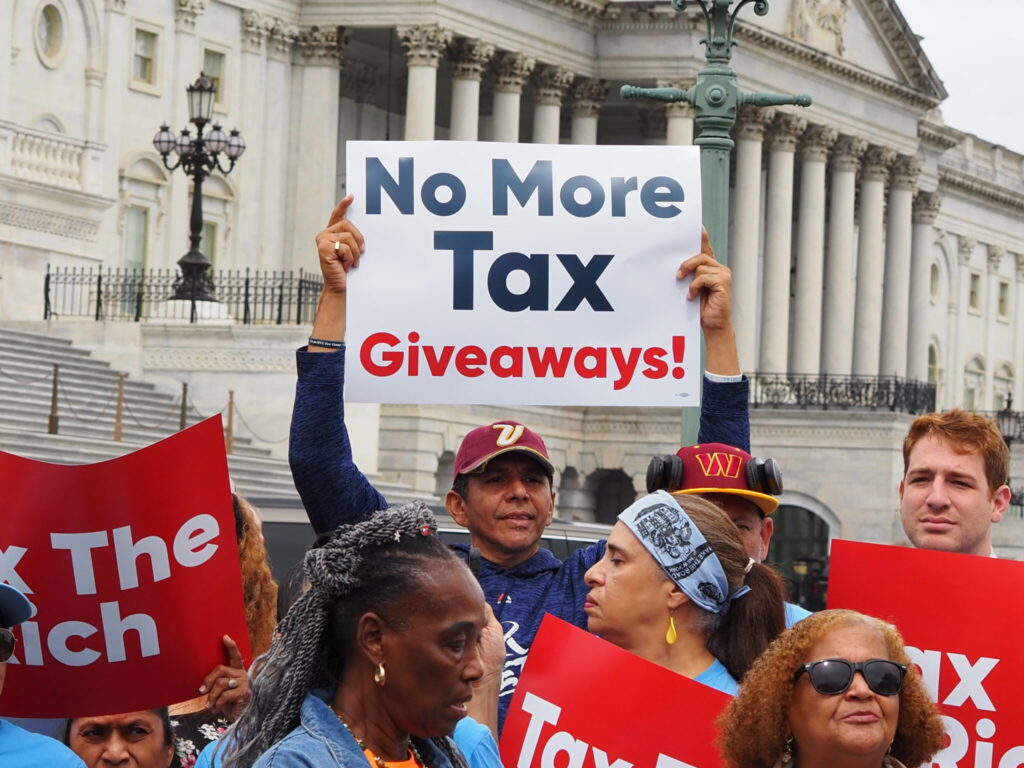

WASHINGTON — Progressive organizations from across the US gathered in Washington D.C. on Wednesday to advocate for “tax justice” as Congress prepares to revisit the tax code in 2025.

Fair Share America, a coalition of state and national advocates, called for an increase in the corporate tax rate and ensuring those earning over $400,000 annually “pay their fair share.”

Advocates from 20 states met with lawmakers and testified before senators, emphasizing local impacts of current tax policies.

Kristen Crowell, executive director of the coalition, stated, “We are getting organized, we are building a multi-racial, multi-sector organization that has real people power on the ground so they can’t cut deals behind closed doors without us holding them accountable.”

Sen. Michael Bennet of Colorado addressed the crowd, expressing support for “tax fairness,” and Rep. Lloyd Doggett of Texas called the effort the “Super Bowl of taxes.”

A group of 61 caregiving advocacy groups pushed for using tax revenue from the wealthy to fund child care and elder care services. Ai-jen Poo, president of the National Domestic Workers Alliance, testified before the Senate Committee on Banking, Housing and Urban Affairs Subcommittee on Economic Policy.

The Care Can’t Wait coalition emphasized the need for public investments in early education, paid family leave, and care for aging and disabled individuals.

Harris, Trump tax promises

The advocacy efforts coincided with tax promises from Vice President Kamala Harris and former President Donald Trump as they campaign for the upcoming presidential election.

Trump pledged on Truth Social to lift a $10,000 cap on the SALT deduction, part of his 2017 tax law, and promised further tax cuts. Analyses from several economists estimate extending Trump’s tax law could add $2 trillion to $6 trillion to the national deficit over the next decade.

Harris’ “opportunity economy” platform includes making the pandemic-era child tax credit expansion permanent, adding a $6,000 credit for new parents, and capping child care costs at 7% of household income. She also proposes increasing the corporate tax rate to 28% and offering tax credits for first-time homebuyers and small businesses.

Organizers from states including Arizona, Michigan, and New York were among those represented on Capitol Hill.