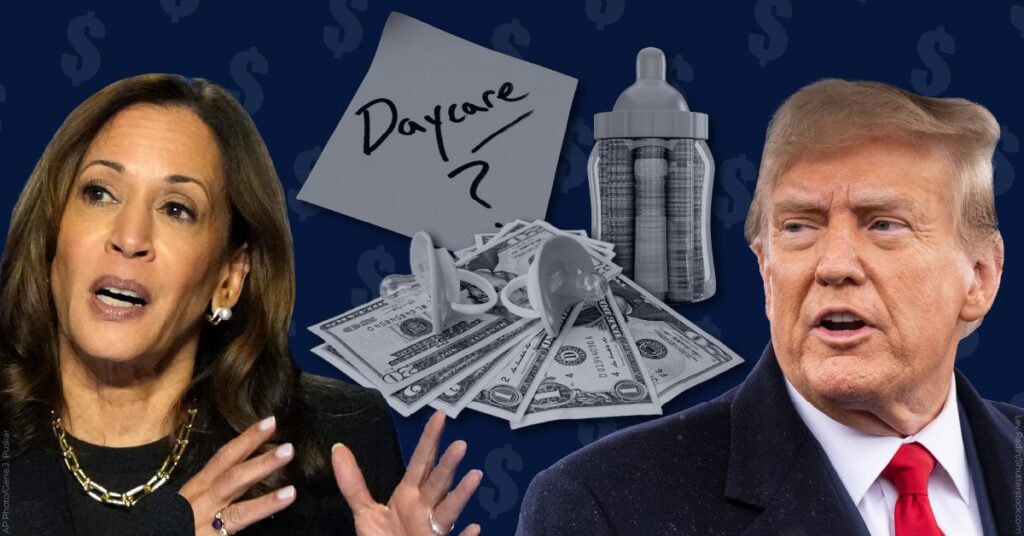

Harris proposes capping families’ child care costs to 7% of their income and offering families of newborns up to $6,000 in the first year of the child’s life. Trump, on the other hand, has focused on tariffs as a solution to the child care crisis, despite evidence showing they would only raise costs for families.

Parents of infants face a tough choice: federal support of up to $6,000 a year and capped child care costs at 7% of income, or tariffs on imported goods?

Kamala Harris, the Democratic nominee for president, has proposed expanding the child tax credit to provide $6,000 in the first year of a child’s life, $3,600 annually for ages one to five, and $3,000 a year after they turn six. This plan aims to ease the financial burden on middle-class and working-class parents.

“A child’s first year is a vital year of critical development, and the costs can really add up, especially for young parents who need to buy diapers, clothes, and a car seat,” Harris said at a rally in North Carolina last month.

Harris also proposed capping child care costs at 7% of working families’ income. “My plan is that no family, no working family, should pay more than 7% of their household income in child care,” Harris stated at a National Association of Black Journalists event.

Policy experts praised Harris’ proposal, noting it would be transformative for families struggling with child care expenses. “Vice President Harris understands the profound impact that the child care crisis has on women, families, early educators, and the broader economy,” said Melissa Boteach of the National Women’s Law Center Action Fund.

In contrast, Donald Trump’s plan focuses on tariffs. During an appearance before the Economic Club of New York, Trump suggested that increasing taxes on imports would address rising child care costs. However, experts argue that tariffs would only raise the cost of other essential items for families.

The American Action Forum reported that Trump’s proposed 10% tariff on imports could add $1,700 to $2,350 in annual costs for American households. Trump’s running mate, Ohio Senator JD Vance, suggested that family members, like grandparents, could help reduce child care expenses. However, this solution may not be viable for families who live far from relatives or face other barriers.

Vance has also suggested raising the child tax credit, but he was not present to vote on a recent bill that aimed to restore the credit to $3,600 annually, as implemented during President Biden’s American Rescue Plan.